PAGE 12 - February 27, 2008

The Newscaster/Nature Coast News

TAX SAVINGS NOTICE

FROM

FRANCIS D. AKINS

Property Appraiser - Levy County

P.O. Drawer 100, Bronson, Florida 32621

Filing Period for Tax Saving Exemptions Ends March 1st

-IMPORTANT-

HOMESTEAD EXEMPTION - $25,000

Homestead Exemption Granted for 2007

6

FLORIDA LAW requires that applications be made by MARCH 1,

Will Automatically Be Renewed for 2008

2007 to be eligible for this $25,000 exemption. In order to qualify for

2 08

07

this exemption you must:

1. Hold title to the property as of January 1, 2007.

2008

2. Reside on the property as of January 1, 20078

200 .

It is no longer necessary to sign and

3. Be a LEGAL resident of the State of Florida as of January 1,2007.

2008

return a Homestead renewal card.

You must then appear personally at the County Property Appraiser's

Office.

PLEASE BRING THE FOLLOWING WITH YOU: Deed or Tax Bill or

Except for Additional Homestead

something showing the legal description of the property on which

you are claiming homestead exemption: Florida Driver's License,

Social Security Card, Florida Car Registration, Florida Voter's

If filing for the first time, you must come

Registration or Declaration of Domicile. If not a U.S. Citizen, bring

to the Property Appraiser's Office.

Residency (Green) card for both husband and wife. If fining on a

mobile home you need to bring title(s) or registration(s) to mobile

home.

ADDITIONAL HOMESTEAD EXEMPTION

1.Must be 65 years of age by January 1, 2008.

2007

4.If you do not file an IRS schedule 1040 income tax return,

2.Annual household adjusted gross income must not exceed

then a sworn statement is required.

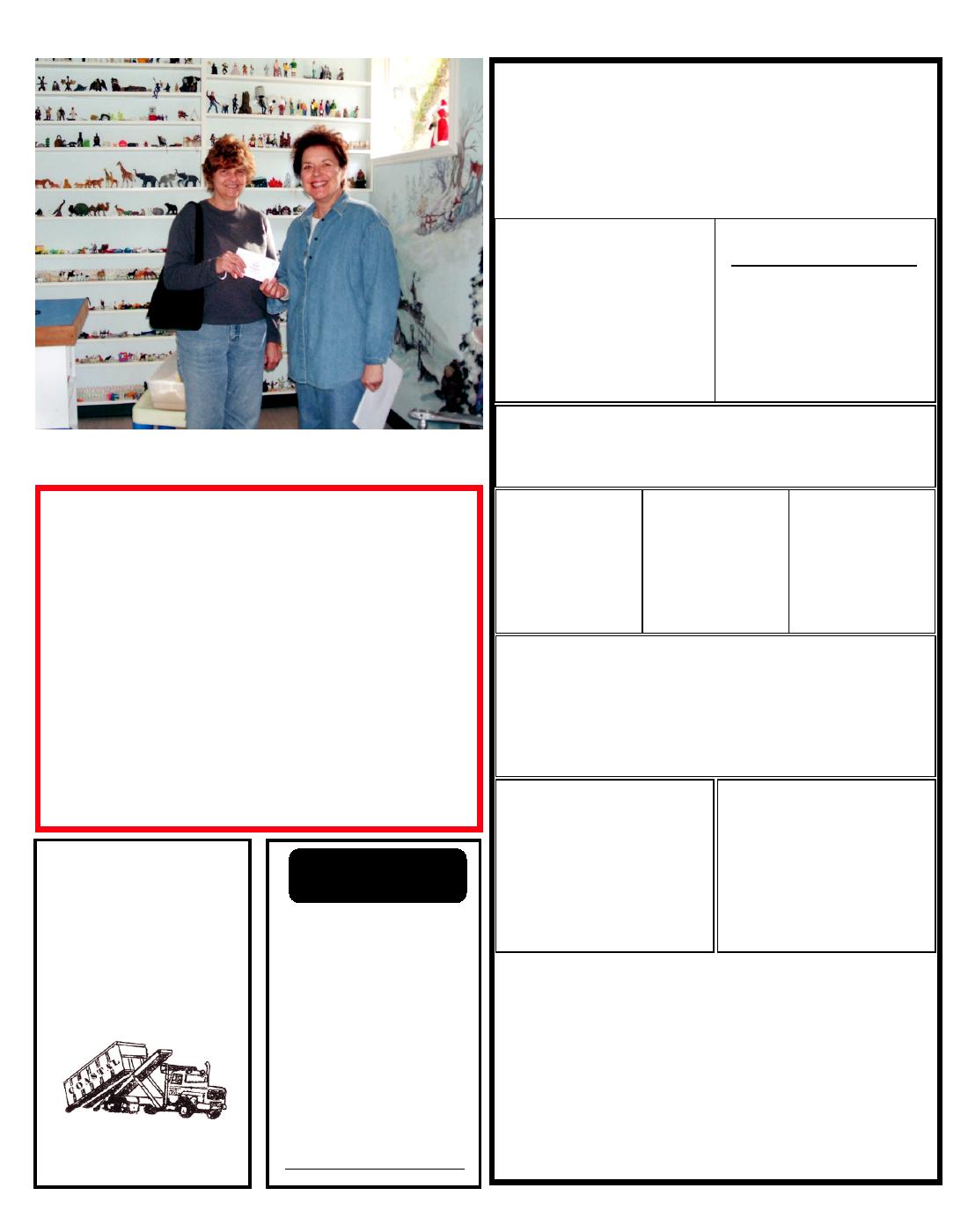

The Joy Circle from the Yankeetown Community Church presented a check to Isaiah's

$24,9167 foyearar 2006.

$24,23 for r ye 2007.

5.Annual statement of income from social security and

Place for children's care and training. Barbara Lewandowski is on the left presenting a check

3.Proof of age and income required.

veterans administration benefits will be accepted.

6.This is an annual application and is not automatically

to Penny Phares ARNP/ RPT-S Director of Clinical Programs.

renewed.

AGRICULTURAL

DISABLED VETERAN'S

$500 WIDOWS/WIDOWERS

Gilley-Long-Osteen VFW Post 8698

(GREENBELT) FILINGS

EXEMPTION

EXEMPTION

A disabled veteran how has 10% or more

520 Hwy. 40 East, Inglis

Any widow/widower who is a permanent

All owners or lessees of agricultural

war time disability is entitled to an

Florida resident may claim this exemption.

(352) 447-3495

lands who desire agricultural

additional $5,000.00 beyond Homestead

Yard Sale & Chili Cook-Off !!!!!

If the widow/ widower remarries, she/he is

Exemption. A "V.A." letter must accompany

classifications for tax purposes on

no longer eligible and if the husband and

application, or other acceptable record of

their property must file an

wife were divorced before his/her death,

disability.

agricultural application with the

the woman is not considered a widow, nor

Veterans who are totally and permanently

Saturday, March 1st

Appraiser between January 1 and

the man a widower. If filing for the first

disabled as a result of certain service

March 1. Agricultural classifications

time, please present a Death Certificate or

connected disabilities should contact the

are automatically renewed.

YARD SALE - 9am-3pm

other proof of your widow/widower status.

Appraiser's Office for determination or

other special benefits.

CHILI COOK-OFF - 12pm-3pm

THE PUBLIC IS WELCOME!

PROPERTY TAX DISCOUNT FOR VETERANS AGE 65 AND OLDER WITH

COMBAT RELATED DISABILITY

All Proceeds will go toward Community Programs - Cup of Chili - $1- Bowl of Chili - $3

A Florida veteran who is age 65 or older who is partially or totally permanently disabled shall receive a discount from the ad

valorem tax otherwise owed on homestead property the veteran owns and resides in if the disability was combat related, the

VENDORS :

veteran was a resident of this state at the time of entering the military service of the United States, and the veteran was

honorably discharged upon separation from military service. The discount shall be in a percentage equal to the percentage of

Inside or Outside Space Rentals $10 - 1 Table Furnished

the veteran's permanent, service-connected disability as determined by the United States Department of Veterans Affairs. To

qualify for the discount granted by this subsection, an applicant must submit to the county property appraiser, by March 1, proof

Limited Space on the Inside - Reserve your Space EARLY

of residency at the time of entering military service, an official letter from the United States Department of Veterans Affairs

stating the percentage of the veteran's service-connected disability and such evidence that reasonably identifies the disability

as combat related, and a copy of the veteran's honorable discharge.

CHILI COOK-OFF ENTRANTS:

Chili to be at the Post at 11:00 am - Entry Fee $6

TANGIBLE PERSONAL PROPERTY

NON-VETERAN DISABILITY EXEMPTION

Exemption $25,000

($$50.00) 0

50 00.0

1st Place $50 - 2nd Place $25 - 3rd Place $15

Tangible Personal Property returns must be filed no later than

Every Florida resident who is totally and permanently

April 1st. Failure to file a return will result in a penalty and an

disabled qualifies for the $500 exemption. If filing for the first

assessment will be made as provided by Florida Law. Tangible

time, present proof of the total and permanent disability by

Nature Coast

Coastal

Personal Property includes property such as business

obtaining a certificate from a licensed physician of Florida.

furniture and fixtures, machinery and equipment, household

Residency must be as of January 1, 2007. Quadriplegics

Water, Inc.

goods, and personal effects. (Florida residents are exempt

should contact the Appraiser's Office for special benefit

from the tax on household goods and personal effects in their

information. If blind or confined to a wheelchair, there is an

Carting

homestead.) The deadline for charitable and qualified non-

income limitation per year, including Social Security, contact

ALL YOUR WATER

profit organizations eligible as such exemption is March 1st. All

the Appraiser's Office for determination of other special

NEEDS SOLVED

others must file by April 1st.

benefits. Disability forms are available at the Appraiser's

Roll-Off Container Service

Office.

GUARANTEED!

Contractors/Homeowners

Reverse Osmosis

HOMESTEAD EXEMPTION IS NOT TRANSFERABLE -- A

10-20-30 yd.

Drinking Water Systems

Dumpsters

NEW APPLICATION MUST BE FILED FOR ANY CHANGES

Softeners

Information will be required from all persons applying for exemptions to determine their

Construction Debris

Iron Filters

residency status. If Husband or Wife is filing for one or both, residency documentation will be

Yard Waste

required for both.

Well Systems

Call (352) 447-6002

We are at your service and will be most happy to assist you in any way.

Our office is located in the Levy County Courthouse.

Toll Free

Francis D. Akins

(888) 610-4947

Property Appraiser -- Levy County

Locally Owned & Operated

Financing Available

P.O. Drawer 100 · Bronson, Florida 32621 · (352) 486-5222

Licensed & Insured

352-465-5020

Rental Units Available

PuPublishnFeb. ,27, 07

b.: Ja . 25 202008